What a journey I have before me here, and what a learning curve I will have to be on for the majority of this. As staring before me, a pathway is littered with ideas, postulations and premises I never could have comprehended merely 6 months ago. But life doesn’t pause despite this realisation; the love of wisdom doesn’t attenuate; nor does the addition of knowledge cease. Which leads to more questions like: why am I here? How did I get here and what the hell does my blog title even mean? If it does in fact mean anything at all! Obviously, I plan to explain the answers to these questions in due time. It will be for me, The Long Walk.

What a journey I have before me here, and what a learning curve I will have to be on for the majority of this. As staring before me, a pathway is littered with ideas, postulations and premises I never could have comprehended merely 6 months ago. But life doesn’t pause despite this realisation; the love of wisdom doesn’t attenuate; nor does the addition of knowledge cease. Which leads to more questions like: why am I here? How did I get here and what the hell does my blog title even mean? If it does in fact mean anything at all! Obviously, I plan to explain the answers to these questions in due time. It will be for me, The Long Walk.In order for a lot of my ongoing positions and statements to make sense later, it is going to be important to explain some basics, and also for the reader to try to understand them. Nominalism being the main one (Plato’s Cratylus is significant in developing this); the opposite concept, “metaphysical realism”, is the ability for objects to exist independently of our experience or knowledge of these objects, irrespective of the concepts in which we understand them - which is the position I am now going to take. However, this can be argued against through idealism, nominalism and the associating immaterialism. The latter is a position that I think can be held in regard to the markets, and largely is but incorrectly, which will be discussed later. But for the time being, we will have to assume the basic building blocks for this blog i.e. the words in the title; do have some actual purchase in their application.

Which brings us to the question I want to introduce today, “How do we measure the incalculable?” Logic or even rationality would dictate we can’t; yet we do on a day to day basis. Which leads to us wondering, what mechanisms do we as humans have or use to make such an evaluation? Does it help if we break down the words? (If you read this blog long enough, you will understand I’m a big fan of etymology.) The word “measure” does not give us much help in itself, except at any given time to provide us with a “standard”. This must place the tension on the word, “incalculable”, root word being calculus, which does have a rich history. Quite literally, meaning “little stone” or “pebble” which was used for tabulating votes, especially in reckoning. Hence the negative connotation associated with a “calculating” person. So incalculable would logically mean, “without end”. “Without ends”, an interesting concept wouldn’t you say? Especially for someone concerned with ethics? So, does this mean we can measure the incalculable because there is no end point? Is it because the process along the way is more existent and important than a “non-ending”?

Unfortunately, I have not been able to answer the question here. All I have done is open a can of worms, and not just in regards to ethical investing, but towards markets and economics/ investing as a whole. It is not to say I don’t have a possible answer, but that it deserves its own post. Until that soon day, I bid you adieu. I did warn you, this will be The Long Walk.

Regards,

Glen.

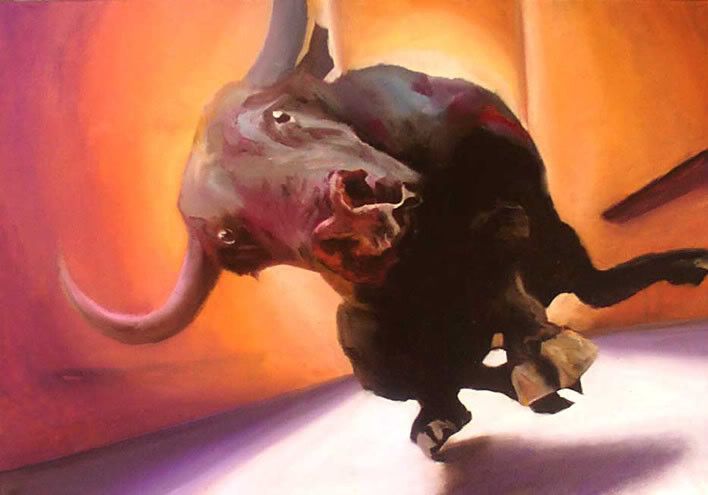

P.S. do you think bull markets have “reckonings” built into them?